starting credit score in india

Top 7 Tips to Build your Credit Score Tip 1 Apply for a Credit Card. Credit score is a 3-digit number ranging between 300 to 900 where a score closer to 900 is generally considered to be a good score.

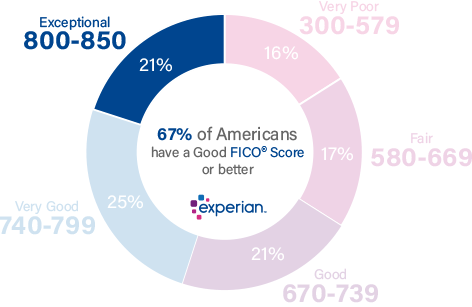

5 Strategies My Husband And I Used To Get A Credit Score Of 800

Your credit score is based on information supplied by lenders to the major credit bureaus and compiled in your credit reports.

. TransUnion CIBIL is one of the four credit bureaus generating reports related to credit scores in India. The more you score to achieve 900 the greater you get credit card approval process. This score will be based on those 6.

Age 21 to 70 must have a regular source of income should have a minimum credit score of 750. What is considered a good credit score. When you check your credit score for the first time you might be surprised to find a three-digit number even if youve never used credit before.

Such information is converted into an easy to understand the score so that one value can give a lender a summary of the borrowers financial health. After 6 months however you will finally have a score. Once you get your first credit card or loan etc.

The truth is that we all start out with no credit score at all. But to open the line of credit you need to build a credit history the right way. 2 Start with the card with the highest interest rate.

A good credit score is considered to be more than 750. October 27 2021 4 min read. Offer you a credit card once you have opened a fixed deposit FD with them.

You dont immediately have a credit score. Scores typically range from 300 and 850 and the higher the better. Lendingkart Finance is a non-deposit taking NBFC which provides working capital loans and business loans to.

Banks check your CIBIL Score before approving your loan. John S Kiernan Managing EditorFeb 15 2016. CIBIL Score is a 3 digit number extend between specified limits from 300 to 900.

Founded in 2013 by Gaurav Hinduja and Sashank Rishyasringa Capital Float is one of the leading Fintech. These bureaus use their algorithms based on the following credit aspects to calculate your credit score in India. CIBIL scores range between 300 and 900.

Thats because your credit score doesnt start at zero. How to Start a Credit Score. The closer the score is to 900 the better it is considered.

A score of 0 on a CIBIL credit report means Credit History Not Available NA which indicates that the credit history is less than six months which is not sufficient to give a credit rating between 300 and 900. A score above 750 is considered to be an excellent score. Credit scores are computed by four major credit bureaus in India including TransUnion CIBIL Equifax Experian and CRIF Highmark.

Get a credit card against FD in a bank. 1 Start with the smallest balance and pay as much as you can towards it while making minimum payments on everything. The basic eligibility for loans in India includes.

The CIBIL credit score is a three digit number that represents a summary of individuals credit history and credit rating. But its highly unlikely your first credit score will be that low unless you start off with very poor credit habits. Many banks in India like ICICI Bank Axis bank etc.

Building a credit history will start you on your way to having a credit score. Top Credit Scoring Startups In India That Use AI Lendingkart. But unless youve had some.

This score ranges from 300 to 900 with 900 being the best score. If you get a credit card and start using it and pay the balance off every month which shouldnt be much then after 3 months your starting credit score of no record found will now be too new to rate. But dont be disheartened as everyone starts out with a blank slate when it comes to building a credit score.

Once you begin to establish a credit history you might assume that your credit score will start at 300 the lowest possible FICO Score. Expect your initial rating to fall to around 670 because you automatically perform poorly on three factors that combine to influence 45 of your number. If it makes sense for you you might want to consider applying for a card with no annual fee.

You can do this in two ways. The score is derived using information from all past credit transactions and loans. Here are a few tips that will help you build a good credit history from start.

While a score between 300 and 549 is deemed to be poor anything from 550 to 700 is deemed to be fair. Credit scores are based on the information in our major credit reports and such reports arent even created until weve had credit eg a credit card or loan in our names for at least six months. You have to give yourself 6 months to a year for your repayment history to reflect as a credit score.

If youre ready for your first credit card it may help you get started. Although all the four credit information companies have developed their individual credit scores the most popular is CIBIL credit score. A good credit score is a key to get a wide spectrum of credit cards and quick loan approvals.

In fact the lowest possible score from FICO or VantageScore is 300. Check your free CIBIL Score and Report and apply for a customized loan. Parameters That Credit Bureaus Use to Calculate Your Credit Score.

Credit Rating Agencies regularly maintain an inflow of information from various sources such as utilities creditors or lenders in order to keep tabs on lenders. Your starting credit score will fall below the median number of 723 even if you pay all of your obligations on time and according to terms during the six-month evaluation period. This is a good way of getting a credit card to build your credit score.

Here we explained about what is good credit score in India and cibil score check. There are predominantly four credit bureaus TransUnion CIBIL Experian Equifax and CRIF High Mark operating in India. Then do the same as above.

In India CIBIL or Credit score plays a very significant role in getting any kind of loans from any lender. Without any credit history reports and scores wont magically burst into. CIBIL Score is the credit score issued by CIBIL Indias first credit bureau and ranges between 300 to 900.

What Is A Fico Score And Why Should You Care Forbes Advisor

:max_bytes(150000):strip_icc()/dotdash_final_800_Plus_Credit_Score_How_to_Make_the_Most_of_It_Dec_2020-01-eab02cc511db4ce19ab3c1869e750d3b.jpg)

800 Plus Credit Score How To Make The Most Of It

Experian Credit Score Check Free Experian Cibil Score Get Credit Report

/dotdash_final_800_Plus_Credit_Score_How_to_Make_the_Most_of_It_Dec_2020-01-eab02cc511db4ce19ab3c1869e750d3b.jpg)

800 Plus Credit Score How To Make The Most Of It

The Average Credit Scores By State Show A Staggering 62 Point Gap Forbes Advisor

If You Don T Maintain Your Cibil Score Then Your Credit Won T Help You In The Future To Improve Your Cibil Score Credit Restoration Easy Loans Credit Score

Worried About Your Credit Score You Can Build It Right Away Stucred Comingsoon Staytuned Credit Score Easy Loans Informative

Improve Credit Score Improve Credit Improve Credit Score Credit Score

Before Processing Of Any Loan Credit Score Needs To Be Examined Now Access Your Cibil Credit Score And Report Free Of Cost Wit Credit Score Scores Credits

Credit Score Credit Score Improve Credit Score Improve Credit

The Average Credit Scores By State Show A Staggering 62 Point Gap Forbes Advisor

800 Credit Score Is It Good Or Bad

A Cibil Score Is The Most Important Criteria For You To Get Access To Credit Products Factors That Affec Credit Repair Services Good Credit Credit Restoration

How To Improve Your Credit Score Forbes Advisor

/dotdash_final_800_Plus_Credit_Score_How_to_Make_the_Most_of_It_Dec_2020-01-eab02cc511db4ce19ab3c1869e750d3b.jpg)

800 Plus Credit Score How To Make The Most Of It

How Much Is Cibil Score Required To Finance Your Car Credit Score Bad Credit Score Scores

Everything You Wanted To Know About Cibil Start Saving Money Free Credit Score Credit Score